The cryptocurrency market saw a huge crash on August 5, 2024. In just three days, the market lost $510 billion, dropping 16.5%. This article will explore what caused this crash and its impact on the future of crypto.

Global Economic Fears: The Spark that Ignited the Crash

The U.S. payroll data on August 5, 2024, sparked the crash. It showed a slowdown in job growth, making investors worry about a recession. This led to a pullback from riskier assets, including cryptocurrencies.

This wasn’t the first time economic fears hit the crypto market. But the timing of the data, combined with other factors, made the crash worse.

Geopolitical Tensions: The Fuel that Fanned the Flames

Conflicts in the Middle East, like between Iran and Israel, worried investors. As tensions rose, investors moved to safer assets, leaving crypto behind.

The crypto market is sensitive to world events. These conflicts made investors cautious, adding to the market’s decline.

Aggressive Selling: The Jump Trading Effect

Jump Trading’s sale of Ether (ETH) was a big factor in the crash. Their actions caused ETH to fall over 21% in one day.

Jump Trading’s actions were a big part of the crash. But the market’s volatility and other factors also played a role in the $510 billion loss.

Leveraged Positions: The Domino Effect

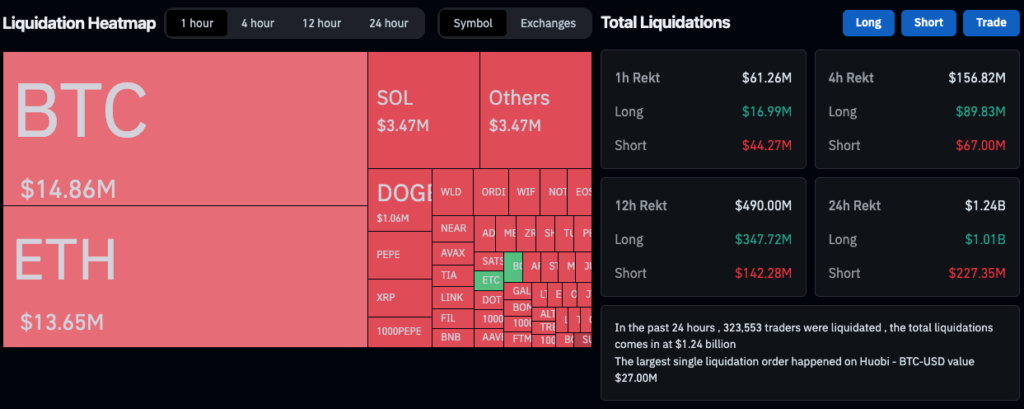

Forced liquidations of $919 million in leveraged long positions made things worse, according to CoinGlass. Investors who had taken on too much risk found themselves unable to meet their margin calls. This led to more selling, worsening the market’s decline.

Leverage can be risky in crypto. It can lead to big losses when the market goes down. In this case, the liquidation of leveraged positions caused a chain reaction that hurt the market.

Interest Rate Hike: The Bank of Japan’s Surprise Move

The Bank of Japan raised interest rates for the first time in over a decade. This made borrowing more expensive and led investors to reevaluate their investments. The surprise move added to the market’s downturn.

This interest rate hike was a big shock. It affected markets worldwide. Investors started to sell riskier assets, including cryptocurrencies.

A mix of economic fears, geopolitical tensions, and leveraged positions created a perfect storm in the crypto market. Investors moved to safer assets, causing a big drop in crypto prices.

Bitcoin (BTC) fell 17% to $50,500, and Ethereum (ETH) dropped 23% to $2,250. The total market capitalization fell 16.5% to $1.86 trillion, losing $510 billion in three days.

Conclusion: What’s Next for the Crypto Market?

The August 5, 2024, crash was a result of many factors coming together. It shows how complex the crypto market is. Understanding these factors is key to navigating its ups and downs.

After the recent crypto market crash, investors are left wondering what’s next. Will the market bounce back, or is this the start of a long bear market? Only time will show, but one thing is sure – the crypto market will keep changing. Investors must be ready to adjust to these changes.

Recommendations for Investors

- Diversification: Spread your investments across a range of assets to minimize risk.

- Risk Management: Set stop-losses and limit your exposure to leveraged positions.

- Stay Informed: Stay up-to-date with market news and analysis to make informed investment decisions.

- Long-Term Perspective: Avoid making impulsive decisions based on short-term market fluctuations.

The August 5, 2024, crypto market crash reminds us of the need to understand the market’s complex factors. By staying informed, diversifying, and managing risk, you can handle the crypto market’s ups and downs. This way, you can make smart investment choices.

Disclaimer

The information provided in this article is for informational purposes only and should not be considered as investment advice. The cryptocurrency market is highly volatile, and prices can fluctuate rapidly. Trading cryptocurrencies carries significant risks, including the risk of losing some or all of your investment.

Investors should conduct their own research, consider their own risk tolerance, and consult with a financial advisor before making any investment decisions. Cryptocurrency investments are not suitable for everyone, and investors should carefully evaluate their financial situation and investment goals before investing.

By reading this article, you acknowledge that you understand the risks associated with cryptocurrency investments and release this blog and its affiliates from any liability for losses or damages that may arise from your investment decisions.